Published on GreenBiz

January 24, 2013

Several decades ago, economist Milton Friedman argued social performance and financial performance are negatively related. According to his theory, when a company increases its social performance, they incur costs and lose competitive advantage. These factors lower profitability.

But many researchers have examined the relationship between social performance and profit and made the case for a positive relationship between the two. The underlying argument is: companies that foster stakeholder trust through social performance have the potential for price premiums, lower transaction costs and greater marketing opportunities. And these factors all increase profitability.

So, who’s right? Everyone, apparently.

Michael Barnett of Rutgers University and Robert Salomon of New York University have found a way to reconcile inconsistencies in past research. The researchers studied the performance of 1,214 companies, drawn from the S&P 500 and Russell 3000 indices, from 1998 to 2006. They determined financial performance by net income and return on assets (ROA). And they determined social performance using Kinder, Lydenberg and Domini data, which evaluate companies according to 13 sustainability criteria.

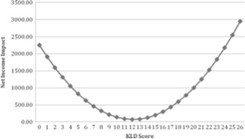

The firms rated low and high in social performance tended to have high financial performance, and the firms with the highest social performance had the highest income and ROA. The most unattractive position was in the middle: firms with only moderate levels of social performance had the lowest financial performance. In other words, the relationship between sustainability and profitability is “U-shaped” and -- crucially -- the right side of the U rises higher than the left. The greatest profitability accrues to the companies with the highest commitment to sustainability.

Milton Friedman and his detractors were both correct because their theories were focused on different parts of the U-curve. Barnett and Salomon reconcile seemingly conflicting past research findings by factoring in a firm’s ability to influence stakeholders over time by investing in social performance.

The key take-aways for business leaders in this debate are:

- Dabbling in CSR gets you stuck in the trough. Superficial improvements to social performance will increase costs and leave stakeholders unmoved -- and financial performance will decline. Instead, leaders should view CSR as a long-term commitment, making it their organization’s raison d’etre.

- Build trust to escape the trough. Stakeholders need to see serious and sustained social performance before firms can accrue the financial benefits of their CSR activities. The key challenge for business leaders is communicating their sustainability efforts such that they generate stakeholder trust.

- It pays more to bake CSR in than ignore it. The payoffs to companies on the right side of the U -- who bake sustainability into their business model – are significantly greater than the cost savings for companies on the left side of the U -- who choose to forgo it.

This story originally appeared the Network for Business Sustainability website and is reprinted with permission.